Victoria Leggett

Head of Impact Development

The content of our website is not intended for persons resident, or partnerships or corporations organised or incorporated inside the United States (“US Residents”). UBP does not market, solicit or promote its services inside the jurisdiction of the United States at any time. The content provided on the UBP website is intended to be used for general information purposes only. Therefore, nothing on this website is to be construed as an investment recommendation or an offer to buy or sell any security...

We aim to deliver risk-adjusted returns over the long term and positive impact through innovative companies at the forefront of sustainable growth.

Impact investing seeks to generate measurable social and environmental benefits alongside competitive financial returns. By allocating capital to companies providing solutions to the world's most pressing challenges, impact investors aim to create positive change while growing their assets. UBP's impact strategies focus on identifying innovative businesses positioned to benefit from the powerful combination of shifting regulations, disruptive technologies, and evolving consumer demands. This distinctive approach uncovers compelling opportunities for long-term value creation, both financial and non-financial, while contributing to a more sustainable future.

Connecting the drivers of sustainable growth

At UBP, we believe companies addressing today's most critical problems are poised to deliver superior investment returns alongside positive societal outcomes. Our impact portfolios are built around businesses with key characteristics: they are innovative solution providers, often in traditional sectors, whose products and services enable the broader economy to meet environmental and social challenges.

While our strategies have an inherent growth bias, the drivers of this growth are distinct from those in conventional portfolios. We see three fundamental pillars supporting the long-term trajectories of our strategies:

By focusing on these secular trends we aim to identify opportunities for superior growth that are less dependent on short-term economic cycles. As a result, our impact strategies are well-positioned to perform over the long run while generating positive change.

Our impact investing strategies are underpinned by a robust and differentiated approach

Our dedicated Impact Investment team brings together professionals with diverse thematic and geographic expertise, maximising our capacity for idea generation. The platform is overseen by the Impact Investment Committee, which meets twice per quarter, and the independent Impact Advisory Board, which meets three times a year.

Informed by the Cambridge Institute for Sustainability Leadership (CISL), our thematic framework distills 15 of the United Nations’ Sustainable Development Goals (SDGs) into six investable themes. This allows us to focus our efforts on the areas where we believe listed equities can have the most significant impact.

Our proprietary Intentionality, Materiality, Additionality, and Potential (IMAP) model puts impact assessment at the heart of our company research. This rigorous framework evaluates a company's current impact and future potential, ensuring that we invest only in businesses making a genuine and meaningful difference.

For us, engagement isn't just part of the process; it's at the very core of what we do. We don't rely on questionnaires or separate teams. Instead, our portfolio managers and analysts engage in ongoing dialogue with companies. This hands-on approach gives us unique insights and allows us to drive positive change.

Our engagement takes several forms:

It fosters cooperation between the private, public and non-profit sectors as part of a deep commitment to multi-stakeholder collaboration to nurture systems change. By combining deep fundamental research, active ownership, and a partnership approach, we seek to deliver compelling financial returns and measurable real-world impact for our clients.

Contact our impact investing specialists to learn how our strategies can help you pursue your financial and sustainability goals.

Our suite of impact investing strategies includes:

Awards

Best ESG Investment Fund: Natural Capital (ESG Investing Awards, 2024)*

* Past performance is not a guide for current or future results.

"Laying the foundations for a secure, stable and prosperous world needs the public and private sector to work together. That is where UBP's impact strategies come in, helping direct capital to forward-looking investments that will bring not only returns now but also dividends for future generations."

Investor Insights

Frequently asked questions about impact investing.

The topics of biodiversity restoration and climate change mitigation are closely interconnected. There is some overlap between the two, but it is a non-reciprocal relationship: what we do to protect biodiversity (e.g. conservation laws and protection of species) tends to be positive for climate change, but the opposite is not always true.

Country risk is a key factor in emerging markets, but while we consider it in stock-picking, we prioritise maintaining a geographically diversified portfolio. On a day-to-day basis, we integrate macro elements into our financial assessments of companies. At portfolio level, we evaluate macro conditions in the markets we invest in and limit our exposure when we see risks.

The experienced Impact Investment team leverages its diverse geographic and thematic expertise to identify the most compelling impact opportunities worldwide. Each team member contributes to all UBP impact strategies as a portfolio manager, analyst, or idea generator. With a presence in developed and emerging markets, the team is optimally positioned to advance the UN SDGs through a solutions-oriented approach.

Key facts and figures

Victoria Leggett

Head of Impact Development

Mathieu Nègre

Head of Impact Investing

Yvan Delaplace

Senior Investment Specialist & Fund Analyst

Glossary

Impact investing is an investment made with the intention of generating a positive social and/or environmental impact alongside financial returns. It exists across a diverse range of asset classes and geographies. Underlying investment candidates should demonstrate a clear “intentionality” within their business model.

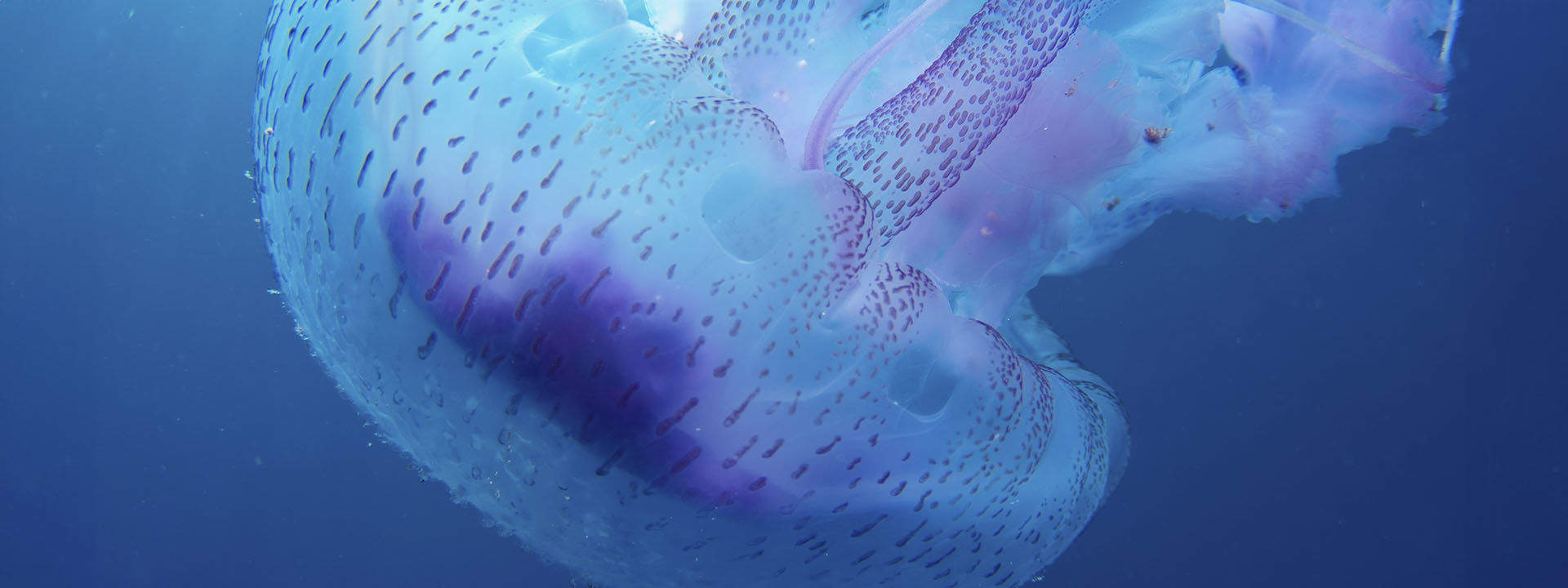

Biodiversity is the variety of life on earth at all levels, from genes to ecosystems, plants and animals.

Biodiversity is an essential part of natural capital and is directly or indirectly linked to other forms of capital in our economic system. USD 44 trillion of economic value generated each year is moderately or highly dependent on nature, which is more than 50% of global GDP, according to a World Economic Forum report.*

*World Economic Forum, New Nature Economy Report Series, 14 July 2020.

ESG (environmental, social and governance) is a term which outlines the key non-financial considerations investors can integrate into their investment process.

The incorporation of these factors is argued to be of key importance both for highlighting opportunities and for avoiding unnecessary risk. Therefore, ESG is an integral part of a responsible investment strategy and a tool for potentially enhancing long-term value.

Responsible investment is evolving from an investment niche to an established, mainstream approach. It has seen substantial growth in recent years due to increasing interest from both institutional and individual investors. Globally, total assets committed to sustainable and responsible investment strategies have grown significantly faster than the market (+25% between 2014 and 2016) and now represent 26% of professionally managed assets.