Robert de Guigné

Group Head of Sustainability

The content of our website is not intended for persons resident, or partnerships or corporations organised or incorporated inside the United States (“US Residents”). UBP does not market, solicit or promote its services inside the jurisdiction of the United States at any time. The content provided on the UBP website is intended to be used for general information purposes only. Therefore, nothing on this website is to be construed as an investment recommendation or an offer to buy or sell any security or investment product, nor as a guarantee or the future performance of any security or investment product.

To browse on UBP.com, please confirm that you are not a US resident.

As an asset and wealth manager, we put future generations at the heart of our decision-making. Inspired by this long-term vision, sustainability has become a growing consideration for all our activities.

Our rationale

Our driving force is our conviction that, to best serve our clients, employees, and society as a whole, environmental and social considerations must be increasingly integrated both into our investment advice and decisions and into our own operations.

"Only by applying environmental, social, and governance criteria, not just to our investments but also to ourselves as a bank, can we realise the long-term vision on which UBP is built and make sure that our clients are well equipped for the financial market conditions of the future."

Our approach

We consider sustainability from two sides: our investments and our operational activities. Within those two areas, we have identified five strategic themes that are key for our long-term success.

Five strategic themes

A dedicated governance structure underpins our approach and ensures strategic oversight as well as well-informed and timely decision-making.

In addition, the Group Risk Committee reviews the Bank’s risk profile and sustainability risk reports monthly.

To ensure strategic oversight, UBP’s Executive Committee and Board of Directors receive quarterly sustainability updates.

With two steering committees, dedicated to investment and operational issues respectively, senior executives get together for strategic decision-making on key sustainability matters.

This committee monitors how we implement sustainability in our investment processes. It designs responsible investment principles and policies and monitors ESG developments.

This committee is responsible for defining, implementing, and monitoring UBP’s approach to sustainability in its own operations such as environmental measures, employee matters and community engagement.

At UBP, we see a strong financial rationale for responsible investing. Protecting and growing our clients’ wealth now and for future generations is our first and foremost duty. This means that we must consider all factors that can affect the resilience and robustness of portfolios.

We also have a responsibility, as a financial institution, to contribute to the transition towards sustainability finance which requires a significant shift in financial flows towards the new economy.

Finally, as we strive to conduct business responsibly and in compliance with regulations, the proliferation of sustainable finance regulations is an additional driving force for embedding sustainability within UBP.

A changing investment landscape

Natural disasters, resource scarcity and other environmental pressures, together with changes in society, regulations, and consumer preferences, are increasingly affecting the profitability and viability of businesses, driving companies to adjust their business models and practices.

Our investment advice and decisions must reflect how investee companies deal with the risks and opportunities that the transition creates. This requires us to consider three elements:

Our dedicated pages on responsible investment for Asset Management and Wealth Management give more details on their respective rationales, approaches, and offering.

We are also committed to managing our direct impact as a business in a responsible manner. Our CSR approach focuses on environmental measures, talent management and working conditions, and community engagement and sponsorships.

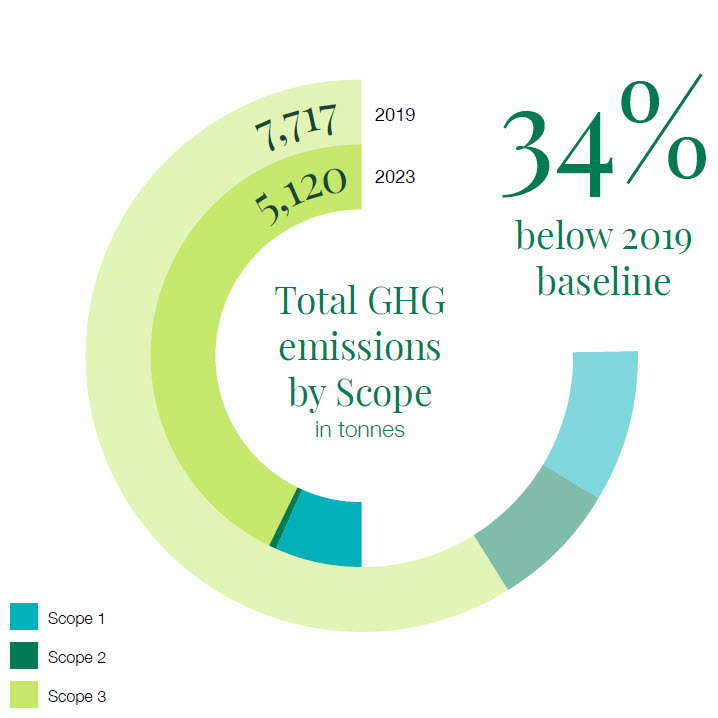

Lowering our operational greenhouse gas (GHG) emissions is the main priority in our environmental management approach. We have committed to a 25% reduction in the carbon footprint of our operations by 2025 compared with 2019 levels. This target covers our operational Scope 1, 2 and 3 emissions.

We focus on the main drivers of our carbon footprint to help us reach this goal.

This includes purchasing renewable energy and enhancing energy efficiency. In addition to installing LED lighting and switching off heating and cooling systems, computers, and other appliances outside office hours, we are refurbishing one of our main offices in Geneva and moving to more energy-efficient buildings when leases expire.

We have a strict approval process for non-client travel and restrictions on air travel. We also promote responsible business travel through awareness-raising measures.

We encourage sustainable commuting solutions and offer employees the possibility to work from home one day per week.

Our 2023 environmental KPIs

99% share of renewable electricity

(including renewable energy certificates where renewable electricity is not available)

70% share of renewable energy

Total GHG emissions by Scope in tonnes

While we aim to achieve an ongoing reduction in our carbon footprint, we have been offsetting our remaining emissions at Group level since 2020.

As a people-driven business, our workforce is key to our continued success. We strive to provide an attractive work environment and continuous opportunities for learning and development.

Learning and development

We offer a range of internal e-learning programmes as well as talent and leadership development programmes, and we support employees in completing external courses. As sustainability knowledge becomes increasingly important, this includes growing our offering for sustainability-related trainings.

Training the next generation

We have a long tradition of supporting young talent through our apprenticeship and internship programmes. In 2021, we introduced an additional one – the Graduate Programme – which offers talented university graduates the opportunity to start their careers at UBP. Learn more about our different programme

Diversity, equity, and inclusion

We are guided by a culture of meritocracy and are dedicated to creating an inclusive and equitable workplace that embraces diversity in all its forms so that employees feel valued, respected, and empowered to reach their full potential.

UBP has always placed great emphasis on engaging with and supporting its local communities and we have a long tradition of supporting cultural, educational, research and social projects in the locations in which we operate.

We also encourage employees to support and join in community action which the Bank organises in partnership with various local charities and NGOs. This ranges from tree-planting and clean-up days to goods donations and support for educational projects.

Collaborating for change

Building a sustainable financial system requires a multi-stakeholder effort. UBP has formed powerful partnerships, taken on a range of strategic commitments, and become a signatory or member of several leading global and local initiatives, associations, and institutions.

"In my opinion, sustainability is about finding ways to carry on operating, developing and innovating in ways that create a healthy environment in which nature can thrive and the next generations prosper. At UBP, this means adopting a pragmatic, patient, and professional approach to anticipating risks and opportunities, and convincing all stakeholders of the importance of striving for that."

Robert de Guigné

Group Head of Sustainability

Robert Wibberley

Head of Sustainability Solutions, Asset Management

Nicolas Barben

Head of Sustainability Solutions, Wealth Management

Nikolett Kovacs

Head of CSR