Victoria Leggett

Head of Impact Development

The content of our website is not intended for persons resident, or partnerships or corporations organised or incorporated inside the United States (“US Residents”). UBP does not market, solicit or promote its services inside the jurisdiction of the United States at any time. The content provided on the UBP website is intended to be used for general information purposes only. Therefore, nothing on this website is to be construed as an investment recommendation or an offer to buy or sell any security...

Unser Ziel sind langfristig risikobereinigte Renditen und positive Auswirkungen durch innovative Unternehmen, die Massstäbe für nachhaltiges Wachstum setzen.

Impact Investing ist darauf ausgerichtet, neben attraktiven finanziellen Renditen auch messbare Erfolge in den Bereichen Soziales und Umwelt zu erzielen. Indem sie Kapital in Unternehmen investieren, die Lösungen für die drängendsten Probleme der Welt bieten, sind Impact-Anleger bestrebt, ihr Vermögen zu mehren und gleichzeitig einen Beitrag zu positiven Veränderungen zu leisten. Unsere Impact-Strategien setzen auf innovative Unternehmen, die vom wirkungsvollen Kräftemix aus Veränderungen in den regulatorischen Rahmenbedingungen, disruptiven Technologien und neuen Konsumgewohnheiten profitieren. Dieser besondere Ansatz ist das richtige Rezept, um attraktive Chancen herauszufiltern, langfristig finanziellen und nicht finanziellen Mehrwert zu schaffen und dabei zur Förderung einer nachhaltigeren Zukunft beizutragen.

Vernetzung der Treiber nachhaltigen Wachstums

Wir sind davon überzeugt, dass bei Unternehmen, die an Lösungen für die drängendsten Probleme unserer Zeit arbeiten, gute Aussichten für überdurchschnittliche Anlagerenditen und positive Auswirkungen für die Gesellschaft bestehen. Zentraler Bestandteil unserer Impact-Portfolios bilden Unternehmen mit einem ganz bestimmen Profil: Sie sind innovative Lösungsanbieter, oft in traditionellen Sektoren, deren Produkte und Dienstleistungen Perspektiven für eine umweltverträglichere und soziale gerechtere Wirtschaft eröffnen.

Unsere Strategien sind zwar grundsätzlich auf Wachstum ausgelegt, doch setzen wir auf andere Wachstumstreiber als in klassischen Portfolios. Für die langfristige Entwicklung unserer Strategien sehen wir drei zentrale Faktoren:

Von der schwerpunktmässigen Ausrichtung auf diese langfristigen Trends versprechen wir uns Chancen auf überdurchschnittliches Wachstum, die weniger stark von der kurzfristigen konjunkturellen Entwicklung abhängig sind. Damit sind unsere Impact-Strategien gut positioniert, um langfristig mit ihrer Wertentwicklung zu überzeugen und gleichzeitig positive Veränderungen herbeizuführen.

Unseren Impact Investing-Strategien liegt ein robuster und differenzierter Ansatz zugrunde

Unser spezialisiertes Impact Investment-Team bündelt die Kompetenzen von Experten mit verschiedenen thematischen und geographischen Schwerpunkten. Damit verfügen wir über maximale Ressourcen zur Ideenfindung. Betreut wird die Plattform vom Impact Investmentkomitee, das zweimal pro Quartal zusammentritt, sowie vom unabhängigen Impact Advisory Beirat, der dreimal jährlich zusammenkommt.

Mit Unterstützung des Cambridge Institute for Sustainability Leadership (CISL) verdichtet unser thematischer Rahmen 15 UN-Nachhaltigkeitsziele zu sechs investierbaren Themen. So können wir uns auf die Bereiche konzentrieren, die sich am besten für Impact-Anlagen mit börsennotierten Aktien eignen.

Unser proprietäres Modell vereint Intentionalität, Materialität, Additionalität und Potenzial (IMAP) und stellt die Wirkungsmessung ins Zentrum unserer Unternehmensanalysen. Dieses Modell gibt einen strikten Rahmen zur Bewertung der gegenwärtigen Wirkung und des Zukunftspotenzials eines Unternehmens vor und gewährleistet, dass wir nur in Firmen investieren, die tatsächlich einen echten Unterschied machen.

Für uns ist Engagement nicht nur ein Teil des Prozesses, sondern das Herzstück unserer Tätigkeit. Standardisierte Fragebögen oder Teams ohne Gesamtüberblick sind für uns keine Option. Vielmehr stehen unsere Portfoliomanager und Analystinnen in ständigem Austausch mit den Unternehmen. Dieser praxisnahe Ansatz gibt uns tieferen Einblick und die Möglichkeit, auf positive Veränderungen hinzuwirken.

Engagement nimmt bei uns verschiedene Formen an:

• Systematisches Engagement durch unser Impact Engagement Framework

• Gezieltes, themenspezifisches Engagement bei konkreten Problemen

• Beteiligung an kollaborativen Anlegerinitiativen und Arbeitsgruppen

Dieser Ansatz fördert die Zusammenarbeit zwischen Akteuren aus dem privaten, öffentlichen und gemeinnützigen Sektor auf der Grundlage der tiefen Überzeugung, dass verschiedene Interessengruppen an einem Strang ziehen müssen, um einen Systemwandel herbeizuführen. Mit der Kombination aus eingehendem fundamentalen Research, aktiver Nutzung von Eigentumsrechten und einem partizipativen Ansatz zielen wir auf attraktive finanzielle Renditen für unsere Kundinnen und Kunden und eine messbare Wirkung in der Realwelt ab.

Kontaktieren Sie unsere Impact Investing-Spezialisten, um zu erfahren, wie Sie Ihre Rendite- und Nachhaltigkeitsziele verwirklichen können.

Unser Angebot beinhaltet folgende Impact-Strategien:

Auszeichnungen

Best ESG Investment Fund: Natural Capital (ESG Investing Awards, 2024)*

*Vergangene Wertentwicklung lässt nicht auf gegenwärtige oder künftige Erträge schliessen.

"Um die Grundlagen für eine sichere, stabile und prosperierende Welt zu legen, müssen öffentlicher und privater Sektor Hand in Hand arbeiten. Die Impact-Strategien der UBP leisten hier einen wichtigen Beitrag, indem sie Kapital in zukunftsorientierte Investitionen lenken, die nicht nur Renditen bringen, sondern sich auch für künftige Generationen auszahlen."

Einblicke in die Anlagewelt

Frequently asked questions about impact investing.

Die Themen Wiederherstellung der Biodiversität und Abschwächung des Klimawandels sind eng verwoben. Es bestehen gewisse Überschneidungen, aber keine Wechselwirkung: Was wir zum Schutz der Biodiversität unternehmen (Naturschutzgesetze und Artenschutz), wirkt tendenziell dem Klimawandel entgegen, umgekehrt gilt dies jedoch nicht.

Das Länderrisiko ist hier ein wichtiger Faktor, den wir bei der Aktienauswahl natürlich berücksichtigen. Priorität hat für uns aber ein geographisch diversifiziertes Portfolio. Im Tagesgeschäft sind makroökonomische Elemente in die finanzielle Beurteilung von Unternehmen integriert. Auf Portfolioebene bewerten wir die gesamtwirtschaftlichen Rahmenbedingungen an den Märkten, in die wir investieren, und begrenzen unser Engagement, wenn wir Risiken sehen.

Mit Experten, die verschiedene geographische und thematische Schwerpunkte abdecken, kann das Team aus einem grossen Reservoir an Erfahrung schöpfen, um die attraktivsten Impact-Chancen weltweit herauszufiltern. Jedes Teammitglied bringt sich als Portfoliomanager, Analystin oder Ideenfinder in alle Impact-Strategien der UBP ein. Mit seiner Präsenz in Industrie- und Schwellenländern ist das Team optimal aufgestellt, um die UN-Nachhaltigkeitsziele durch einen lösungsorientierten Ansatz voranzubringen.

Das Team in Zahlen und Fakten

Glossar

Impact-Investing sind Anlagen, die neben Finanzrenditen messbare positive Auswirkungen für die Gesellschaft und die Umwelt generieren sollen. Sie werden in vielen Anlageklassen und Regionen getätigt. Die Unternehmen, die als mögliche Kandidaten für Impact-Anlagen in Frage kommen, sollten ein klares Engagement in ihrem Geschäftsmodell aufweisen.

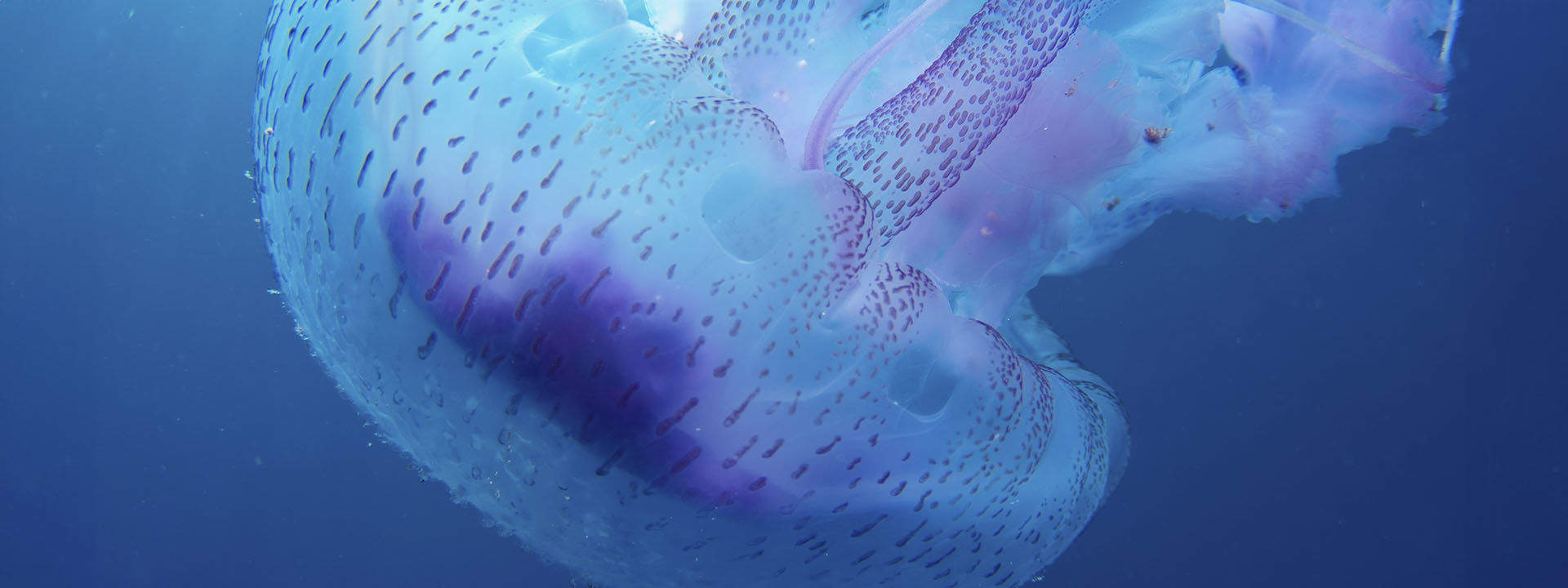

Biodiversität bezeichnet die biologische Vielfalt von Leben in allen seinen Formen, die Tier- und Pflanzenarten, deren genetische Variationen und Ökosysteme.

Die Biodiversität ist ein wesentlicher Bestandteil des Naturkapitals und direkt oder indirekt mit anderen Kapitalformen unseres Wirtschaftssystems verbunden. Laut dem Bericht des Weltwirtschaftsforums sind mehr 50% des globalen BIP, d. h. USD 44 Billionen des jährlich generierten ökonomischen Werts, teilweise oder stark von der Natur abhängig.*

*World Economic Forum, New Nature Economy Report Series, 14 July 2020.

Das Akronym ESG steht für die Kriterien «Umwelt» (Environment), «Soziales» (Social) und «Unternehmensführung» (Governance) und bezeichnet die wichtigsten nicht-finanziellen Aspekte, welche die Anleger in ihre Investitionsstrategie einbeziehen können.

ESG-Kriterien sind ein integrierter Bestandteil einer verantwortungsbewussten Anlagestrategie und ein Instrument zur Steigerung der langfristigen Wertentwicklung.

Verantwortungsbewusstes Anlegen ist in den letzten Jahren stark gewachsen und hat sich dank des zunehmenden Interesses von privaten und institutionellen Anlegern von einem Nischensegment zu einem etablierten Verfahren entwickelt.

Die verwalteten Vermögen im Bereich sozialverträglicher Anlagen wuchsen weltweit stärker als der Markt (+25% zwischen 2014 und 2016) und machen derzeit 26% der professionell verwalteten Vermögenswerte aus.