Mathieu Nègre

Head of Impact Investing

The content of our website is not intended for persons resident, or partnerships or corporations organised or incorporated inside the United States (“US Residents”). UBP does not market, solicit or promote its services inside the jurisdiction of the United States at any time. The content provided on the UBP website is intended to be used for general information purposes only. Therefore, nothing on this website is to be construed as an investment recommendation or an offer to buy or sell any security or investment product, nor as a guarantee or the future performance of any security or investment product.

To browse on UBP.com, please confirm that you are not a US resident.

瑞联通过投资于走在可持续发展最前线的创新公司,以在长期带来经风险调整回报率和发挥正面影响力。

影响力投资寻求在带来具竞争力的财务回报时,对社会和环境产生可衡量的利益。通过配置资本给为全球最迫切的挑战提供解决方案的公司,影响力投资旨在创造正面的转变和增长资产。瑞联影响力投资策略专注于物色创新企业,这些公司具备条件受益于包括监管改革、颠覆性科技和消费者需求转变的三大趋势。瑞联特有的 影响力投资方式,能够开发这些将在长期创造财务和非财务价值的机会,同时对转型至更可持续发展的未来作出贡献。

把握推动可持续发展的增长动力

瑞联深信,今天已经坐言起行应对最关键问题的公司,将有条件在未来实现理想的投资回报和为社会带来正面成果。我们的影响力投资组合旨在纳入具备以下特质的公司:提供创新解决方案的供应商(对象通常是传统行业),而其产品和服务促进广大经济以应对环境和社会的挑战。

尽管我们的影响力策略大体上偏向于增长型资产,但推动这些增长的动力与在传统投资组合中的资产截然不同。我们识别了三大基本支柱,支持瑞联影响力投资策略在长远持续增长:

借着聚焦于这些长远趋势,瑞联旨在物色不受短期经济周期影响的增长良机。故此,瑞联影响力投资策略有条件在长远带来佳绩,并且引发正面的转变。

瑞联影响力投资策略立足于以下四种相辅相成的投资方式:

瑞联影响力投资团队通过影响力平台,让在不同地域精于不同主题的专家济济一堂、集思广益,以提升我们启发意念的能力。影响力平台由瑞联影响力投资委员会(Impact Investment Committee)监督,每季度举行两次会议,另有由董事会成员担任主席的独立影响力咨询委员会(Impact Advisory Board)督导,该委员会每年举行三次会议。

由英国剑桥大学可持续领袖学院的投资领袖组(CISL)提供研究资料,瑞联的主题框架将联合国可持续发展目标(SDG)的其中15项目标,融入六大可投资主题,使我们能够集中力量于上市股票有望发挥最显著的影响之范畴。

瑞联自有开发的IMAP系统是我们研究和衡量被投公司影响力之核心,通过从意向性(Intentionality)、重要性(Materiality)、额外性(Additionality)及潜力(Potential)的四大准则,以评核企业现时的影响力强度和未来的潜在影响,从而确保我们可以不偏不倚地,只投资于真正带来不一样的公司。

对瑞联来说,与企业进行议合计划并不仅是投资程序的其中部分,而是我们投资操作的核心。我们不会依赖发出问卷或将责任外发给其他团队,而是由投资组合经理和分析师直接与公司管理层持续对话。这种亲力亲为的方式,使我们能够对相关公司建立更深层和独到的见解,并有利于我们推动正面转变。

瑞联企业议合计划以下列几种方式进行:

这些工作促进民间、公营和非营利组织之间的合作,是多个利益关系者协力推动体系转变的深层次承担。通过结合深度基本面研究、积极拥有权和组成合作伙伴,瑞联寻求为客户带来具吸引力的财务回报,以及在实体世界产生可衡量的影响力。

“为安全、稳定和繁荣的世界奠定良好根基,需要公营和民间部门携手合作,这就是瑞联影响力投资策略在此中担当的角色,协助引导资金直接投资于具前瞻性的项目,这不仅在现在便带来回报,也为后世产生效益。”

投资淡谈

Frequently asked questions about impact investing.

生物多样性修复与减缓气候变化的课题息息相关,两者有一些重叠,但并不存在相互的关系:当我们保护生物多样性时(例如实施保育法例和保护物种等),通常有利于减缓气候变化,但未必是反之亦然。

市场风险是投资于新兴市场的重要风险,但在选股时,我们首要确保投资组合妥善分散投资于不同的地域。就日常操作来说,我们将宏观元素整合于我们对企业财务的评审之中。至于在投资组合的层面,我们评估在所投资的市场中之宏观情况,并在留意到风险时限制投资量。

影响力投资团队运用其对广阔地域和多元化主题的投资专业,在全球识别最具吸引力力的影响力投资机会。每位团队成员都身兼投资组合经理、分析师或启发意念者的角色,以为瑞联所有影响力投资策略作出贡献。投资团队的投资分布发达和新兴市场,通过解决方案为本的方式促进实现联合国SDG。

投资团队:概要和数据

Glossary

Impact investing is an investment made with the intention of generating a positive social and/or environmental impact alongside financial returns. It exists across a diverse range of asset classes and geographies. Underlying investment candidates should demonstrate a clear “intentionality” within their business model.

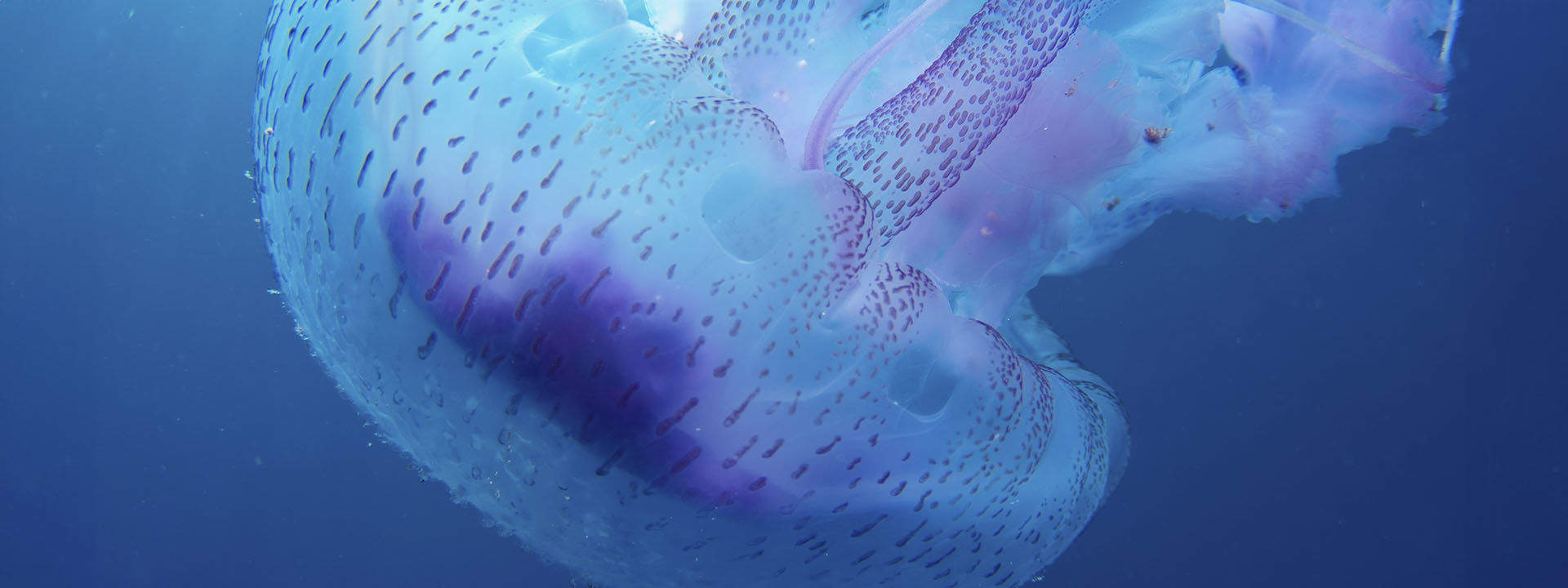

Biodiversity is the variety of life on earth at all levels, from genes to ecosystems, plants and animals.

Biodiversity is an essential part of natural capital and is directly or indirectly linked to other forms of capital in our economic system. USD 44 trillion of economic value generated each year is moderately or highly dependent on nature, which is more than 50% of global GDP, according to a World Economic Forum report.*

*World Economic Forum, New Nature Economy Report Series, 14 July 2020.

ESG (environmental, social and governance) is a term which outlines the key non-financial considerations investors can integrate into their investment process.

The incorporation of these factors is argued to be of key importance both for highlighting opportunities and for avoiding unnecessary risk. Therefore, ESG is an integral part of a responsible investment strategy and a tool for potentially enhancing long-term value.

Responsible investment is evolving from an investment niche to an established, mainstream approach. It has seen substantial growth in recent years due to increasing interest from both institutional and individual investors. Globally, total assets committed to sustainable and responsible investment strategies have grown significantly faster than the market (+25% between 2014 and 2016) and now represent 26% of professionally managed assets.