As environmental and social challenges intensify and sustainability regulations are on the rise, the transition to a new economic model is gaining momentum.

We recognise that sustainability issues are profoundly reshaping the investment landscape, creating new risks and opportunities, particularly in the long term. We must therefore consider non-financial factors in our investment advice and decisions through careful and balanced analysis to protect and grow our clients’ wealth for years to come.

Guy de Picciotto, Chief Executive Officer

Strengthening our in-house capabilities

To ensure that we are well positioned to navigate the transition successfully, we continued to lay strong foundations throughout 2023.

In particular, we hired a dedicated ESG team for our wealth management business to help us strengthen our responsible investment expertise and meet demand for sustainable investment solutions among private clients.

We delivered comprehensive ESG training for our front-office employees and support teams. This was a crucial first step in enhancing their conviction and knowledge, therefore equipping them with the ability to talk to their clients about sustainability preferences.

Another key milestone was the creation of our centralised ESG database. This state-of-the-art tool will enable our investment management teams to select, review and model ESG information in order to provide clients with high-quality expertise and data-supported investment advice, while ensuring that all ESG data is synchronised and consistent across all users.

Responsibly managed assets on the rise

Last year, responsibly managed assets totalled some CHF 22.4 billion, up from CHF 21 billion in 2022. This increase was driven by an overall rise in assets under management on the Asset Management side as a result of significant inflows into responsibly managed funds, which were partially offset by outflows from mandates and Article 6 funds.

Tackling financed emissions

Our investments are the main way in which we can contribute to the global decarbonisation agenda. In line with the recommendations of the Task Force on Climate-related Disclosures (TCFD), in 2023 we monitored and disclosed climate metrics for our asset and wealth management business as well as for our own investments.

On the asset management side, we continued to reduce the carbon footprint and weighted average carbon intensity (WACI) of our funds and mandates invested in equities and corporate bonds, particularly by increasing allocations to low carbon equity strategies. The estimated temperature score remained stable in 2023 for our funds and continued to trend down for our mandates. The carbon intensity of our sovereign holdings also came down during the period.

UBP’s emission-reduction measures

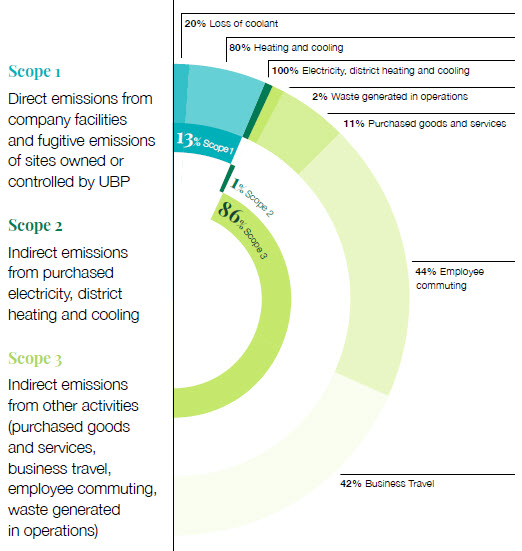

UBP continued with the implementation of carbon reduction measures for its operational greenhouse gas (GHG) emissions, working towards its goal of reducing them by 25% by 2025 compared with 2019. Despite UBP’s continued growth, total GHG emissions increased only 3% and remained 34% below the baseline year figure of 2019.

Notably, our Scope 2 emissions were down 93% compared with the previous year as we continued to switch to renewable electricity and purchase renewable energy certificates (RECs) for locations where it is not available. This allowed us to increase the proportion of electricity coming from renewable sources to 99%.

In addition, we were able to reduce our energy consumption by 6% in 2023 thanks to a range of energy-saving measures.

However, to reach our emissions reduction goal, we must now scale up our efforts to tackle emissions from commuting and business travel, which respectively account for 38% and 36% of our overall emissions.

Share of GHG emissions by scope and source

Nurturing partnerships

Strong and trusting partnerships are a core element of our sustainability approach. On the investment side, we therefore contributed to important discussions and research on the topic of nature. This included the “Nature Calls” biodiversity conference that we hosted in London, the panel discussion on sustainable food systems that we co-hosted at Building Bridges, Switzerland’s leading sustainable finance conference, and our contribution to the University of Cambridge Institute for Sustainability Leadership (CISL) report “Let’s Discuss Nature with Climate: Engagement Guide”.

With regard to our communities, we continued our support through projects and sponsorship in the cultural, social and environmental fields, such as clean-up events, donations of goods and fundraisers.